Running a small business in today’s unpredictable world comes with plenty of uncertainties. From natural disasters to cyber threats and legal claims, there’s no shortage of scenarios that can disrupt daily operations. That’s where commercial insurance plays a vital role—serving as a safeguard that helps businesses stay resilient through unexpected events.

If you’re a small business owner in the U.S., understanding what coverage you need—and why—can be one of the smartest moves you make to protect your investment and long-term growth.

The Real-World Risks That Business Owners Face

Business owners often juggle multiple roles—manager, marketer, accountant, and sometimes even janitor. But one hat many forget to wear is that of the risk manager. The truth is, risks aren’t always dramatic or headline-making. Sometimes, they’re as simple as a customer slipping on wet flooring or an employee making an error that results in a costly lawsuit.

Take this example: a boutique owner in Florida suffered massive inventory damage after an unexpected tropical storm caused flooding. Her out-of-pocket expenses would have been devastating—if not for her tailored policy. That financial safety net allowed her to reopen quickly and retain her staff.

What’s Typically Covered?

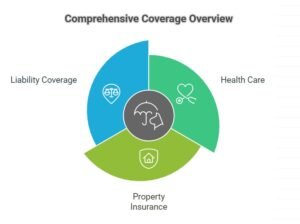

Policies vary based on the type and size of the business, but most offer protection in key areas:

Property Damage

Whether it’s fire, vandalism, or weather-related incidents, your business space and equipment are critical assets. This coverage helps with repair or replacement costs.

Liability Claims

If someone gets injured on your premises or you’re accused of negligence, liability coverage can help handle legal fees, settlements, or medical expenses.

Business Interruption

A temporary closure can mean a total halt in income. This protection helps cover lost revenue and operating costs during downtime.

Employee-Related Risks

From workers’ compensation to employment practices liability, policies can be structured to support and protect your team.

Providers like Biz2Insure make it easier to compare options that align with your business model, helping owners customize what matters most.

Why Small Businesses Are Especially Vulnerable

While large corporations may recover from a lawsuit or natural disaster due to their deeper pockets, small businesses typically operate on much tighter margins. A single event—like a fire or client dispute—can lead to expenses that are difficult to absorb.

According to the U.S. Small Business Administration, about 25% of businesses fail to reopen after a major disaster. That statistic alone underscores the need for a reliable backup plan.

Biz2Insure has seen increased demand among local restaurants, contractors, and wellness studios who now view coverage as a basic necessity, not just an option.

Cybersecurity Is No Longer Optional

With more businesses operating online—whether selling products, managing appointments, or storing customer data—digital risks have become one of the fastest-growing threats. Even a brief website outage or data breach can lead to financial loss and reputational damage.

Specialized coverage for cyber liability is now being included in many modern policies. For example, a small accounting firm in Texas avoided major legal fallout after a phishing attack led to client data exposure. Their policy helped cover recovery costs, legal counsel, and communication with affected clients.

Forward-thinking platforms like Biz2Insure help guide business owners through this increasingly complex space.

It’s About Peace of Mind and Long-Term Strategy

Beyond the practical support, having Commercial Insurance in place changes how you make decisions. Knowing you’re protected allows you to take calculated risks—whether that’s hiring more staff, opening a second location, or investing in expensive equipment.

It’s easier to build partnerships and sign contracts when vendors and clients see that you’re operating responsibly. Many leases and business agreements even require proof of coverage before the deal is signed.

That’s where partnering with a resource like Biz2Insure becomes more than just a transaction—it becomes a strategic move.

How to Choose the Right Policy

Start with a Risk Assessment

Look at the nature of your business: Are you customer-facing? Do you rely heavily on equipment? Are your operations seasonal? These questions can shape your ideal coverage.

Avoid Over- or Under-Insuring

While it’s tempting to cut corners to save money, a bare-bones policy may leave critical areas exposed. On the other hand, unnecessary extras can bloat your premiums.

Ask About Industry-Specific Options

Construction companies, medical practices, tech startups—they all have unique needs. Make sure your provider understands your field.

Real People, Real Protection

A Brooklyn-based dog groomer experienced a power outage during a heat wave, resulting in equipment damage and canceled appointments. Their insurance helped cover the cost of repairs and recouped lost revenue from the days they had to close.

A freelance graphic designer was sued over copyright issues in a client project. Professional liability coverage paid for legal representation and helped protect their reputation.

These aren’t outliers—they’re everyday situations where a proactive approach made all the difference.

It’s Easier Than You Think to Get Started

One of the barriers for many business owners is the assumption that finding a Commercial Insurance policy is time-consuming or confusing. But the process has evolved. Many platforms now offer simple, streamlined tools to compare quotes, explore add-ons, and purchase policies in minutes, not days.

Biz2Insure, for example, is designed to serve businesses of all sizes with customizable options, friendly support, and a clear focus on education, not pressure sales.